Table of Contents

Choosing the right bank account for your small business can feel like figuring a maze. With countless options and features to consider, it’s easy to get overwhelmed. But the right account can make a world of difference, streamlining your finances and helping your business thrive.

You might think all bank accounts are the same, but they’re not. From transaction limits to monthly fees, each account offers unique benefits and drawbacks. By understanding what to look for, you can find an account that fits your business needs perfectly, saving you time and money in the long run.

Importance Of A Bank Account For Small Business

A bank account for small business growth can be the perfect safe place to store money, making it the heartbeat of your future financial operations. When you separate your personal finances from your business funds, everything becomes clearer and simpler. Tracking income and expenses gets easier, allowing you to see your financial health at a glance.

You might wonder why this matters. Think about taxes. When tax season arrives, having a dedicated account helps you keep records clean. Accurate records make filing less stressful and can help you avoid fines. If the tax office ever audits you, it’ll be easier to provide the evidence they demand.

A business bank account can foster professionalism. You expect customers to take you seriously, right? When clients pay into a business account with your company’s name, it boosts credibility. Professionalism, in turn, might unlock more opportunities for growth.

Banks often offer additional features tailored for business needs. Imagine the benefits of overdraft protection, lines of credit, or merchant services. These tools can lend a helping hand when cash flow gets tight or when you need to make a significant purchase. Plus, having a history of transactions can help demonstrate creditworthiness. Strong credit can open doors to loans and better terms.

Consider what happens if you’re a partnership or limited company. Legal requirements often oblige you to maintain separate accounts. Mixing funds can complicate things and might even lead to legal trouble. You can’t afford to overlook any detail, no matter how small it seems.

Think about managing your expenses. Many business accounts offer tools to categorise and track spending automatically. You can identify where money goes and spot areas to cut costs. It might also simplify budgeting and financial planning.

Look at the bigger picture: saving time. Manual reconciliation of transactions takes time, and time is valuable. Business accounts often integrate with accounting software, reducing manual input and errors. In a world where minutes matter, saving time can translate to saving money.

Reflect on security. Keeping business funds separate adds an extra layer of protection. If your business faces financial troubles, your personal financial health might remain unaffected. This separation can safeguard both your business and personal life.

Opening a business bank account might seem like just another task on your to-do list, but it holds significant long-term benefits. It sets a foundation for financial organisation, credibility, and growth. Skipping this step could cost you more than you think. What are you waiting for? Take the leap and open an account today.

Types Of Bank Accounts

Choosing the right bank account is essential for managing your small business finances efficiently. Different accounts offer various benefits that can cater to your specific needs.

Current Accounts

Current accounts are fundamental for daily business transactions. These accounts allow you to manage incoming and outgoing payments with ease. You can write cheques, make deposits, and set up direct debits. International payments or expensive supplies? Current accounts handle these with ease. They often provide overdraft facilities, helping manage your cash flow when revenues dip. Most banks offer online services, ensuring you have everything at your fingertips whenever necessary.

Savings Accounts

Savings accounts are ideal for managing surplus funds. They offer higher interest rates compared to current accounts, helping increase your savings over time. You should consider one to grow your reserve fund, ensuring you’re prepared for unexpected expenses. Think about this—is your surplus just sitting idle? Savings accounts can also offer easy access, making it simpler to transfer funds to your current account when needed. Banks often link these accounts for seamless transfers, highlighting their utility for long-term goals.

Merchant Accounts

Merchant accounts are vital for businesses that handle several transactions. They enable you to accept credit and debit card payments, both online and in-store. If you service numerous customers daily, such accounts can streamline payment processes. Imagine how convenient it is for your customers to pay with their preferred method—merchant accounts make it possible. They often come with additional tools like point-of-sale systems, making financial tracking and reporting straightforward. Merchant accounts can basically turn payment complexity into simplicity, offering your customers more payment options.

Selecting The Right Bank

Choosing the right bank for your small business is crucial for financial health and growth. Your selection can impact day-to-day operations and long-term success. Let’s dive into key considerations.

Evaluate Banking Needs

Identify your business’s unique needs first. Think about the volume of transactions and types of services required. Are international transactions frequent? Do you need a high number of cash deposits? Different businesses will have different necessities. Consider the growth phase of your business, as your banking needs might change over time. Reflect on what services and features could support your business now and in the future.

Compare Bank Fees

Bank fees vary widely. Review and compare fee structures from different banks. Pay attention to monthly maintenance fees, transaction fees, and minimum balance requirements. Some banks might offer fee waivers if certain conditions are met. Don’t overlook promotional offers for new accounts. While low fees are attractive, balance them with the quality of services provided. By focusing on fee structures, you can avoid unexpected costs that could affect your bottom line.

Customer Service

Quality customer service can save time and reduce stress. Investigate how different banks handle business inquiries and issues. Are dedicated business advisors available? Check reviews and ask other business owners about their experiences. Imagine being able to resolve problems quickly without long waits or unhelpful responses. Efficient customer service can be a lifeline, especially during critical times. A bank that values your business will invest in providing excellent support and resources to help you thrive.

Key Features To Look For

When choosing a bank account for your small business, you need certain features to maximise efficiency. Here are the critical ones.

Online Banking

Online banking is essential for managing finances conveniently. It lets you transfer funds, check balances, and pay bills 24/7. Some banks offer advanced features like real-time alerts and detailed transaction history. Consider a bank’s website functionality and security measures. Can you perform all necessary tasks online? Is the interface user-friendly? Reliable online banking saves time and ensures you stay on top of your finances, allowing you more focus on growing your business.

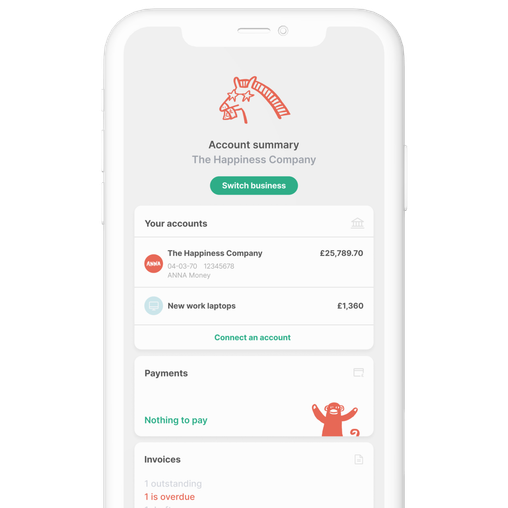

Mobile Banking

Mobile banking makes financial management possible on-the-go. Banks usually offer apps compatible with both Android and iOS devices. Check for features like mobile cheque deposit, transaction notifications, and account management tools. How intuitive is the app? Does it support all transactions you need? Strong mobile banking support boosts productivity, helping you manage your business even when you’re away from your desk.

Overdraft Options

For small businesses, overdraft options can provide a financial safety net. Look for flexible overdraft limits tailored to your business needs. Understand any fees or interest rates associated with overdrafts. Ask yourself, does the bank offer a buffer for unplanned expenses? Can the terms be adjusted as your business grows? Knowing your overdraft options helps avoid cash flow issues, keeping your operations smooth and uninterrupted.

Integration With Accounting Software

Seamless integration with accounting software streamlines financial management. Popular options include Xero, QuickBooks, and Sage. Check if the bank supports direct feeds into your accounting system. Does it simplify reconciliation? Does it support real-time updates? This feature reduces manual data entry and the risk of errors, making financial tasks easier and more accurate. Effective integration can transform how you handle finances, providing clear insights into your business’s financial health.

Final Thoughts

Choosing the right bank account for your small business is more than just a financial decision; it’s a strategic move that can significantly impact your company’s success. By considering your specific needs and evaluating the features and services offered by different banks, you can find an account that enhances your business operations and supports your growth. Remember to prioritise convenience, security, and integration capabilities to ensure a seamless banking experience. With the right account, you’ll be well-equipped to manage your finances efficiently and focus on what you do best—growing your business.